We have assembled an unparalleled combination of experience, insight, and skill. Harnessing environmental data and analysis, we strive to reliably achieve superior returns for our investors.

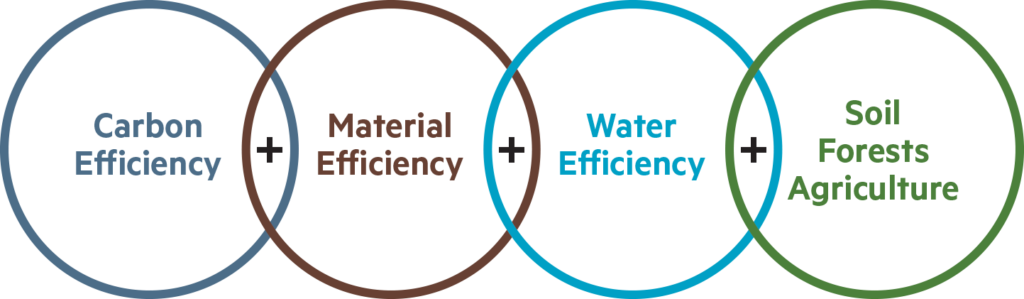

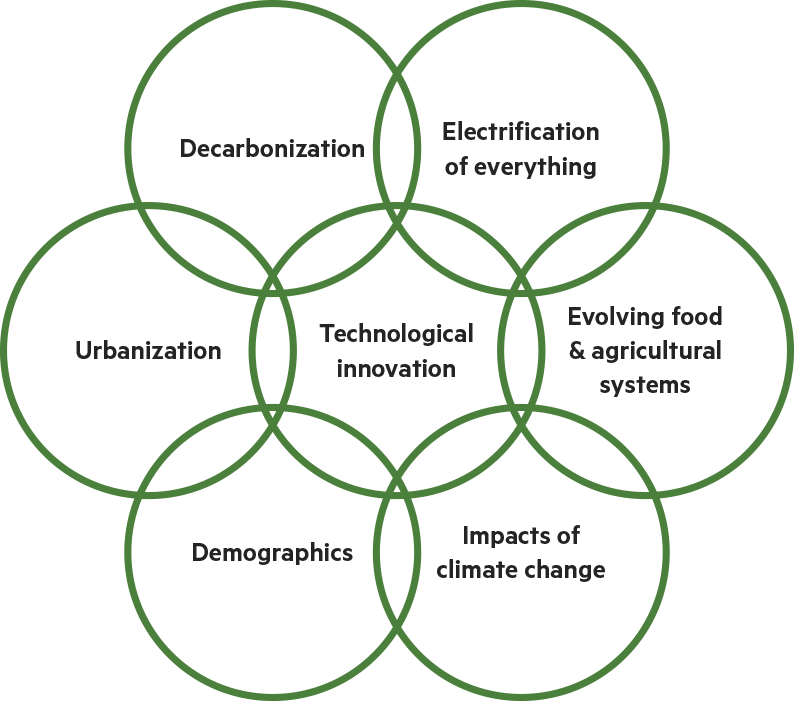

Terra Alpha Investments is a public equity manager founded in 2014 by highly experienced investors who share the conviction that our rapidly evolving world requires a change in investment thinking. Our rigorous and proprietary Environmental Productivity (EP) analysis values our planet’s natural resources and sits at the center of our successful investment process. Our innovative process of quantitative and qualitative analysis helps us identify companies with the optimal combination of Enduring Business Models (EBM) and superior EP. We believe this process is the primary driver of our ability to deliver superior long-term investment returns for our investors.